Some employers may want to check an applicants credit history as part of a background check. Financial responsibility, or irresponsibility, can speak to an applicants trustworthiness and reliability, two attributes that are hard to determine by a resume or interview alone. Furthermore, credit reports turn up more information than a candidate’s credit history. Aliases are also often uncovered which can allow for a whole new set of information to be uncovered. Some states, like Indiana, are closely examining the issue and considering expanding the reach of credit checks to include school job applicants like teachers.

Other states, however, are reversing their stance on credit checks. The argument is employers are over stepping and not using credit checks appropriately, which discriminates against those who can’t afford to pay off their debt. If a dated arrest record can’t count against you, why should bad credit?

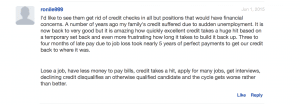

Consider this reader comment from an Ohio newspaper article on background checks:

Here’s a better view:

“I’d like to see them get rid of credit checks in all but positions that would have financial concerns. A number of years ago my family’s credit suffered due to sudden unemployment. It is now back to very good but it is amazing how quickly excellent credit takes a huge hit based on a temporary set back and even more frustrating how long it takes to build it back up. Three to four months of late pay due to job loss took nearly 5 years of perfect payments to get our credit back to where it was.

Lose a job, have less money to pay bills, credit takes a hit, apply for many jobs, get interviews, declining credit disqualifies an otherwise qualified candidate and the cycle gets worse rather than better.”

It’s situations like this that are leading many lawmakers to reconsider whether it’s necessary to use credit reports in hiring decisions. Seven states (CA, CT, HI, IL, MD, OR, WA) have passed laws prohibiting employers from pulling credit reports and New York City most recently banned credit checks as a qualifier for employment. According to the National Conference of State Legislatures (NCSL), more than 20 states are currently considering similar legislation. To find out whether your state is among them, go to the NCSL’s detailed chart on www.ncsl.org.

nolo.com, a legal site filled with lots of user-friendly information, has done a good job explaining the basics behind many of these decisions. “If your state prohibits you from checking applicants’ credit reports or using their credit histories in your hiring decisions, you can’t do it,” writes Nolo.com. “Even though the federal Fair Credit Reporting Act allows employers to consider credit reports, state laws that are more protective of employee rights trump the federal law.”

Have more questions for us? We’d love to help find solutions to your problems. Send us a comment below or Tweet us here.